What Does Ach Processing Do?

Table of ContentsGetting The Ach Processing To WorkThe smart Trick of Ach Processing That Nobody is Talking About7 Simple Techniques For Ach ProcessingThe Ultimate Guide To Ach ProcessingSome Known Details About Ach Processing Ach Processing Things To Know Before You Buy

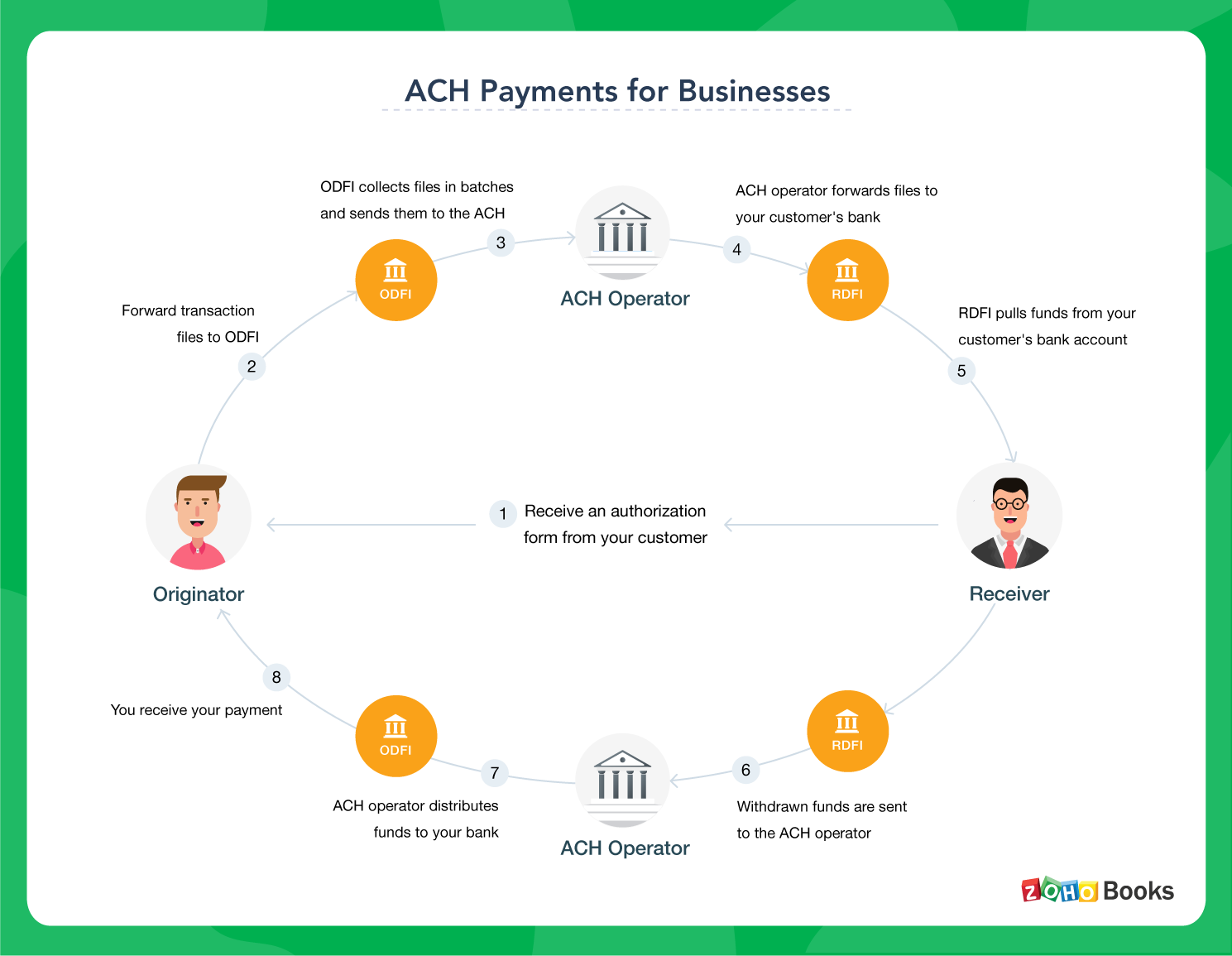

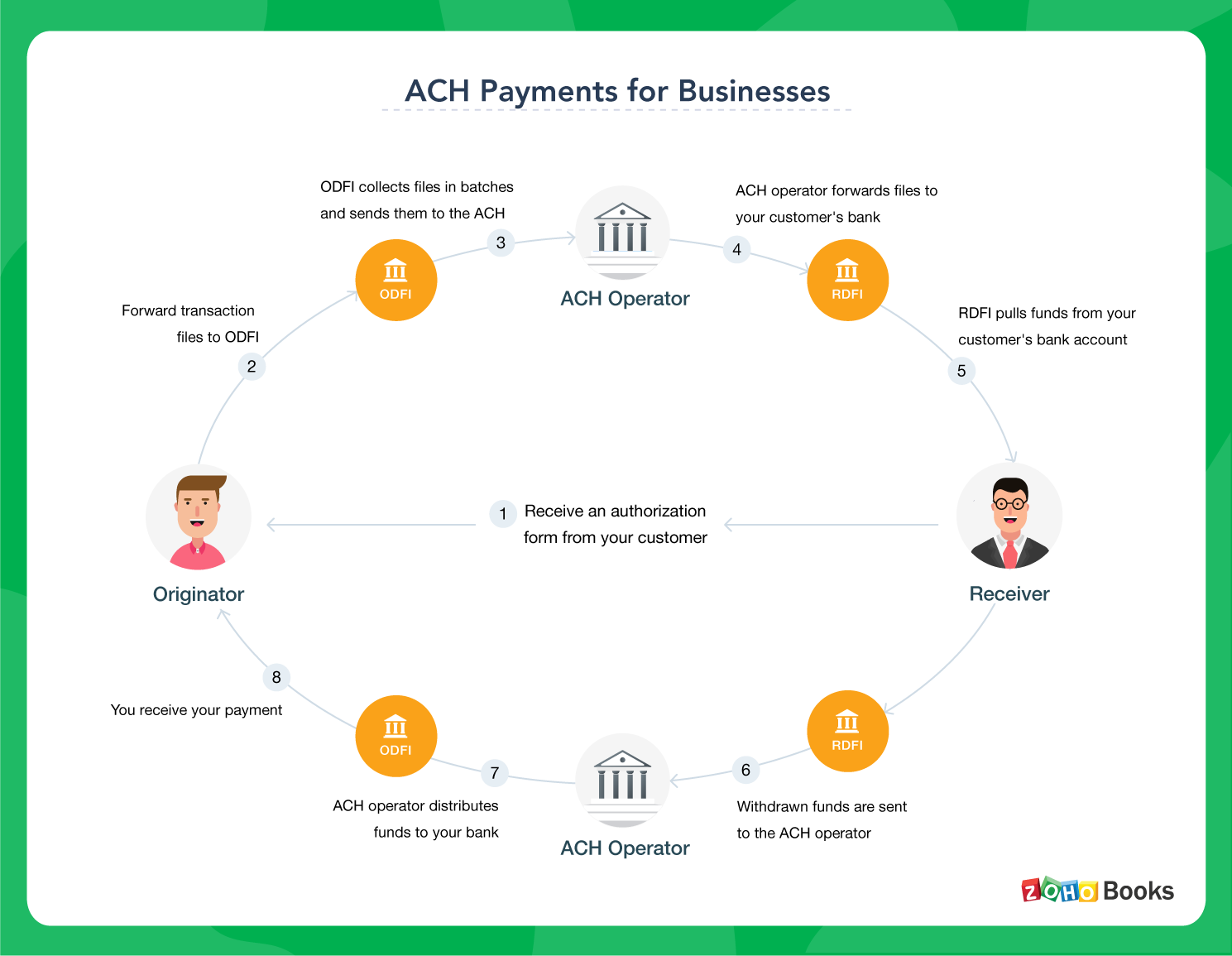

The Federal Book then kinds all the ACH files and after that transmits it to the receiver's financial institution the RDFI.The RDFI after that processes the ACH files and credit ratings the receiver's (Hyde) account with 100$. The example over is that of when Jekyll pays Hyde. If Hyde has to pay Jekyll, the very same process happens backwards.The RDFI submits the return ACH documents to the ACH network, along with a reason code for the error. ACH repayments can offer as a fantastic alternative for Saa, S companies.

With ACH, considering that the purchase handling is recurring as well as automated, you wouldn't have to wait for a paper check to show up. Since clients have actually accredited you to accumulate payments on their part, the flexibility of it enables you to accumulate single settlements. No more uncomfortable emails asking customers to pay up.

The Main Principles Of Ach Processing

Debt card payments fail because of numerous reasons such as run out cards, blocked cards, transactional mistakes, etc - ach processing. Occasionally the customer can have surpassed the credit limit and also that might have resulted in a decline. In situation of a bank transfer via ACH, the bank account number is utilized along with a consent, to charge the consumer and also unlike card deals, the chance of a financial institution transfer failing is extremely low.

Unlike card transactions, financial institution transfers fall short only for a handful of reasons such as insufficient funds, wrong financial institution account details, etc. The two-level verification procedure for ACH repayments, makes sure that you preserve a touchpoint with customers.

The consumer initially increases a request to pay through ACH and after that, after confirming the customer, ACH as a settlement alternative is allowed for the particular account. Just then, can a customer make a straight debit payment via ACH. This confirmation consists of checking the legitimacy as well as authenticity of the financial institution account.

The 8-Minute Rule for Ach Processing

This safe process makes ACH a reliable option. If you're taking into consideration ACH, head here to understand just how to accept ACH debit payments as an on the internet business. For every charge card deal, go to this web-site a percentage of the cash included is divided throughout the various entities which allowed the repayment. A significant chunk of this fee is the Interchange charge.

and is normally approximately 2% of the complete purchase cost. In case of a transaction directed by means of the ACH network, considering that it straight deals with the financial network, the interchange charge is around 0. 5-1 % of the total deal. Right here's some quick math with some basic percent prices to make things less complex: Let's claim you have a business consumer who pays you a yearly membership charge of $10,000.

Some Ideas on Ach Processing You Should Know

Freelancing system Upwork has utilized fascinating approaches to drive ACH adoption. They bill 3% more on the bank card purchases. Furthermore, they charge high quantity (even more than $1000) users Website with only $30 flat charge for unrestricted ACH deals. You can drive boosted fostering of ACH payments over the long-term by incentivizing consumers making use of benefits as well as advantages.

ACH transfers are electronic, bank-to-bank money transfers refined via the Automated Cleaning House (ACH) Network. According to Nacha, the organization liable for these transfers, the ACH network is a set processing system that banks and other economic establishments usage to accumulation these deals for processing. ACH transfers are electronic, bank-to-bank money transfers processed with the Automated Clearing Residence Network.

Ach Processing Can Be Fun For Anyone

Straight settlements entail money going out of an account, consisting of expense settlements or when you send out money to somebody else. ACH transfers are practical, fast, and often complimentary. ach processing. You may be restricted in the variety of ACH transactions you can launch, you might incur added fees, as well as there might be delays in sending/receiving funds.

7% from the previous year. Person-to-person and also business-to-business purchases additionally increased to 271 million (+24. ACH transfers have several usages as well as can be a lot more cost-effective as well as straightforward than creating checks or paying with a credit or debit card.

Some Ideas on Ach Processing You Need To Know

ACH transfers can make life simpler for both the sender and also recipient. Gone are the days when you needed to write out and wait for a check to clear, or when you had to walk your expense settlement to the electric business prior to the due day. While all of this is still possible, you now have various other choices.

Comments on “Some Ideas on Ach Processing You Need To Know”